The cryptocurrency market is currently experiencing a

bullish atmosphere, with assets like Bitcoin (BTC) continuing to hold onto its

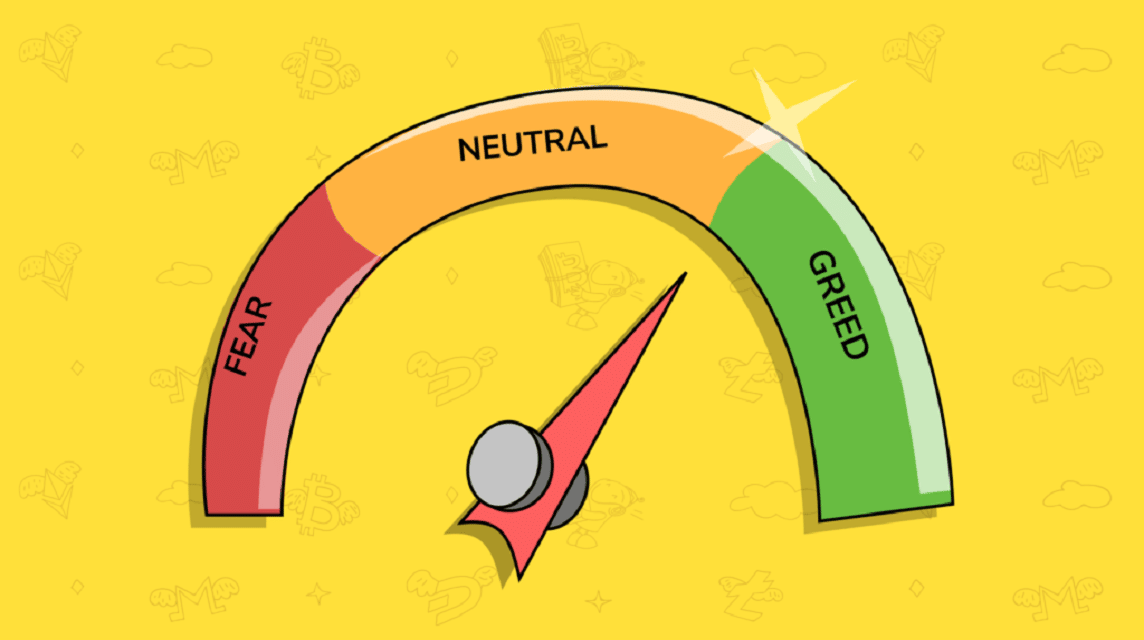

recent gains. This sentiment is mirrored by the Fear & Greed Index, which

has been reaching record highs.

On January 30th, the Fear & Greed Index, compiled by

Coinglass, registered a reading of 61 - indicating a great level of greed, the

highest since the crypto market was in a bull run in November 2021.

The sentiment reading has gone up significantly since December 2022, when the crypto market was experiencing a bear market.

It is evident that the crypto market has taken a turn

towards a state of high optimism, as investors are displaying high expectations

in the potential of cryptocurrencies in the future.

Consequences of Fear & Greed Index

It is noteworthy that the Fear & Greed Index is composed

of various components, for example, volatility, market momentum, social media

involvement, and trading volume. When the reading is higher, the index is

likely trending towards greed, with plenty of buyers in the market. On the

other hand, lower readings indicate that fear has taken over the market.

The bullish sentiment is mirrored in the behaviour of assets

like Bitcoin, which managed to reclaim the $23,000 mark after acting as a major

obstruction to progress.

Nevertheless, it is essential to be prudent when considering

the current degree of avarice, as the market is still uncertain. For instance,

technical indicators point to the fact that Bitcoin might be facing in one

week. Simultaneously, it is likely that a possible bullish golden cross formation

will take place in early February.

Meanwhile, a machine learning program is forecasting a

probable sustained climb in the cost of Bitcoin in the near future. As per an

article by Finbold, the machine learning algorithms at PricePredictions anticipate that the digital currency might reach

$24,342 on February 28, 2023.

Cryptocurrency has seen an impressive surge of almost 40% in

2023 and this industry is still highly dependent on macroeconomic factors.

Later this week, the Federal Reserve meeting will reveal their decision on

interest rate hikes and this will be a topic of great interest.

Due to the decline in inflation, the Federal Reserve could

choose to adjust their interest rate policy.

Exploring the Value of Bitcoin

The first-ever cryptocurrency is presently trading at $23,262, exhibiting a growth of almost 2% within the last seven days.

In the end, even with the attempts by bears to gain control

of Bitcoin, the cryptocurrency has demonstrated its strength. Right now,

experts suggest that it may reach back up to $28,000. [pc]

source: Finbold

0 Komentar