Last week, a U.S. judge came to a summary judgement in the LBRY vs SEC

case, which has the potential to have a favorable impact on the securities law

as this precedent can be applied to the Ripple vs SEC case. The latter utilizes

the obscure phrase "secondary market" in its argument.

Additionally, IG bank in London published an article concerning the Ripple Labs vs SEC case. The article surmises that a positive

result in this case could lead to a surge in the XRP price and a resulting

improvement in the whole cryptocurrency market.

John Deaton, the creator of Crypto Law and a supporter of Ripple, publicly aired his doubts about the SEC commissioner's statement that their case was not very strong. He shared his views on Twitter.

Although new facts have come to light, there is still no

definitive news about the outcome of the XRP vs SEC case.

If Ripple fares well, it could be an inspiration to Fintech

companies to flock to the United States. Conversely, if the outcome is not

positive, then a large number of crypto businesses and skilled personnel may choose to leave.

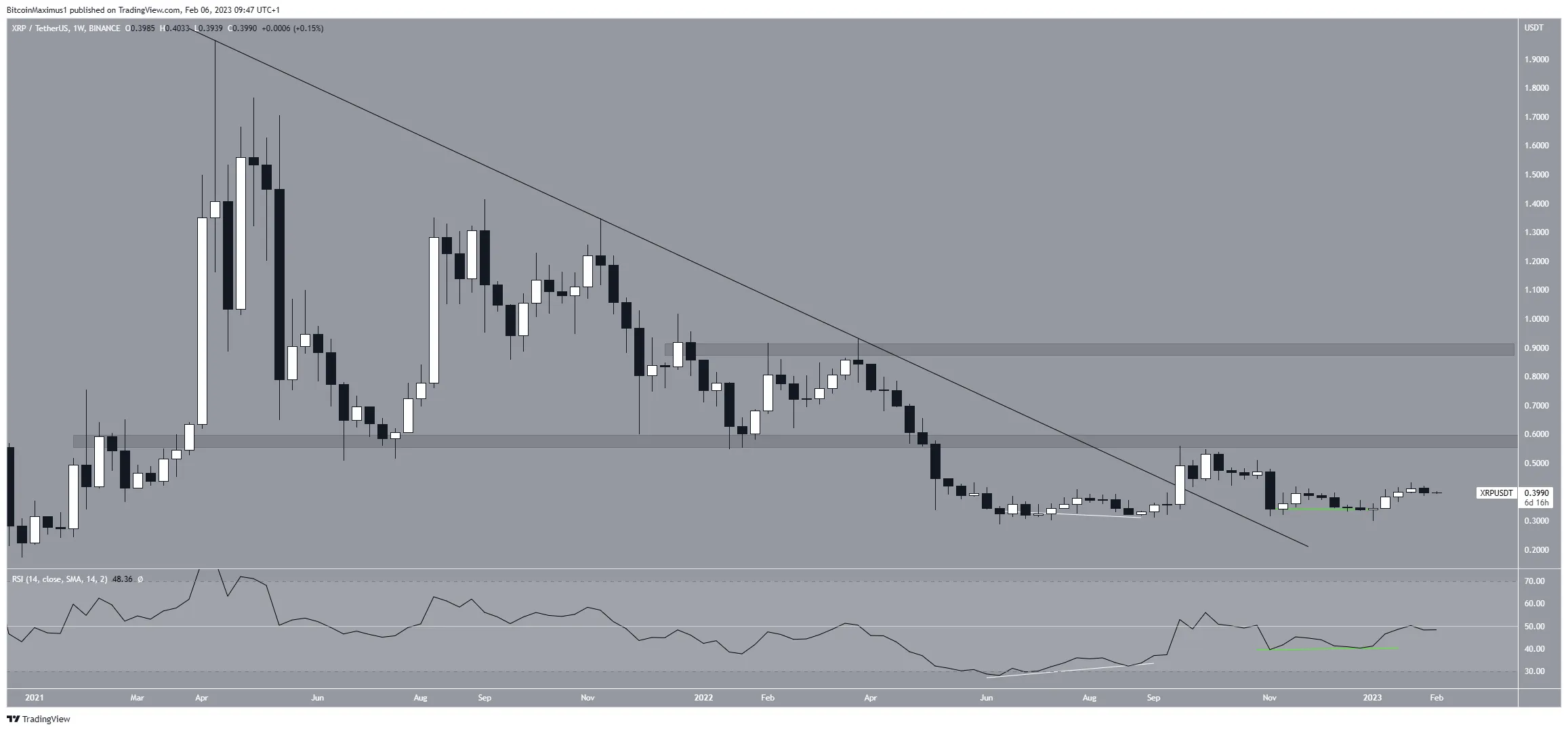

Uplifting Momentum Still In Place

Since April 2021, the value of XRP has been decreasing

beneath a long-term downtrending line of resistance. This led XRP to hit a

floor of $0.287 in June of 2022.

Subsequently, the value started to increase, and in

September, it managed to go beyond the resistance line due to a positive

divergence in the weekly RSI (illustrated by the white line). Nevertheless, its upward trend could not be

kept, and XRP is now trading beneath its breakout point.

Nevertheless, the outlook for the near future appears to be optimistic. The weekly Relative Strength Index has produced a new bullish divergence (depicted as the green line), similar to the one seen before the break out. Consequently, the value may climb to the $0.580 horizontal resistance level, and if it surpasses that, it could reach an average of $0.900.

Should the weekly closing price drop below $0.300, it would

be seen as bearish and may lead to the crypto's value sinking to $0.200.

Forecast of XRP Price in February

Since June 2022, the XRP price has been contained within the

walls of a symmetrical triangle according to the technical analysis of the

daily chart. This triangle is seen as a neutral pattern, meaning either a

breakout or a breakdown could occur.

Beincrypto reports that, a bullish hammer candlestick on Jan. 2 (black icon) has

signaled the start of the current uptrend and prevented the triangle formation from

deteriorating. Additionally, the XRP price has been able to recuperate the

$0.385 support level and verify it as such (green icon). These developments are

all considered to be bullish indications.

In the preceding day, the XRP cost has descended after being refused by the triangle. Nevertheless, the daily RSI has established a subtle bullish divergence (marked by the green line).

This is a suggestive sign of

trend prolongation, which may result in an outburst. If it plays out, $0.505

will be the following level of opposition. This is a close to 30% rise from the

present cost.

Should XRP close below $0.385, the bullish forecast would be

nullified and the rate would drop back to $0.340.

In conclusion, it appears that the most probable XRP price estimation for February would be an emergence from the triangle followed by a rise to $0.505.

Anything positive about XRP could hasten this process.

Conversely, should the day end with a close beneath $0.382, this bullish

expectation would be invalidated, resulting in XRP returning to the $0.340

support level. [pc]

0 Komentar