As the crypto landscape evolves, a recent analysis suggests that the myriad technical difficulties that have beleaguered Bitcoin and the broader cryptocurrency market may be subsiding. This shift comes amid significant developments, including the liquidation events at FTX and the reemergence of previously defunct entities from bankruptcy.

These changes signal a potential pivot in the market dynamics, with macroeconomic factors expected to play a more pivotal role in the coming weeks, reported by the weekly Coinbase research report.

In an unprecedented trend, US spot Bitcoin ETFs have witnessed net inflows averaging over $200 million daily in the last week. This surge has propelled the total net inflows since January 11 to a staggering $1.46 billion, accompanied by a robust daily volume of approximately $1.35 billion.

Such momentum hints at a growing investor confidence and a bullish outlook for the digital asset class, bolstered by the easing of previous technical pressures.

The analysis further delves into the broader economic landscape of the United States, where the prospect of a soft landing for the economy appears increasingly feasible. Despite the intricate balance between sustaining economic activity and managing inflation, recent indicators suggest a resilient economic environment.

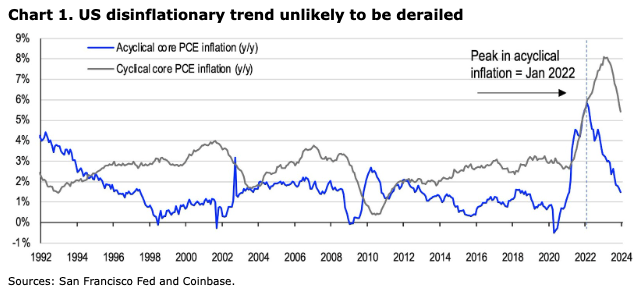

The Core PCE inflation rate, a key metric for the Federal Reserve, aligns closely with the long-term target, painting a picture of a stable economic trajectory.

However, challenges loom on the horizon. The widening US budget deficit and a cooling labor market raise concerns about the sustainability of current economic drivers, such as government spending and personal consumption.

The decline in the US personal savings rate to 17.6% underscores the potential for a slowdown, although the risks of a full-blown recession remain low. Yet, the situation at New York Community Bancorp and its implications for regional banks presents a notable concern.

Recent Federal Reserve communications provide insights into the central bank's perspective on these developments. The Federal Open Market Committee (FOMC) has indicated a shift towards a more balanced approach to achieving its employment and inflation goals.

While the Fed remains cautious, delaying decisive actions on its quantitative tightening program, the anticipation grows for potential policy easing starting May 1, with a halt to balance sheet reduction possibly commencing in June.

Such monetary policy adjustments would not only reflect the Fed's response to the disinflationary trend but also align with historical patterns observed in election years. Moreover, these changes coincide with specific events within the crypto sector, such as the anticipated Bitcoin halving in late April, which could further invigorate the market.

The expected increase in advertising by ETF issuers and the inclusion of spot Bitcoin ETFs in asset managers' portfolios are poised to unlock additional liquidity for cryptocurrencies. As technical barriers recede and macroeconomic factors assume a central role, the landscape for Bitcoin and other digital assets stands at the brink of a significant transformation.

This evolution could herald a new era for cryptocurrencies, characterized by enhanced stability, increased investor participation, and a deeper integration with traditional financial systems.

As we navigate through these changing tides, the interplay between easing technical pressures and emerging macroeconomic influences presents a complex yet promising horizon for the cryptocurrency market. Stakeholders, from investors to policymakers, must remain attuned to these shifts, as they could redefine the trajectory of digital assets in the global financial landscape. Lets see. [pc]

0 Komentar